The Fed’s tapering should not be viewed as a reduction in their accommodative monetary policy; rather the Fed is anxious to return to a more normal posture in the financial markets and to regain flexibility of action to respond to future market panics. Historically (pre QE) an accommodative Fed position in the market would be reflected in a steep positive yield curve. A positive yield curve is made up of lower short term interest rates and higher long term rates. In an effort to rebuild the demand of a devastated housing market; the Fed, through QE, has forced the curve flatter during a period of monetary accommodation resulting in historically low mortgage rates. Recent data does argue that the Fed’s stimulus targeting housing has worked in spite of continued credit tightening by banks unwilling to lend. The current yield curve explains to a large extent bank’s hesitation to lend. Banks generally borrow short and lend long. A relatively flat yield curve does not create incentives for banks to lend because spreads are too narrow. Indeed the traditional response to a restrictive money policy is a flat yield curve as the Fed seeks to cool the economy by reducing credit. So, during this recent emergency move described as quantitative easing (QE), the Fed has been working at cross purposes by targeting retail demand for mortgage while reducing incentives for banks to lend. Continue reading

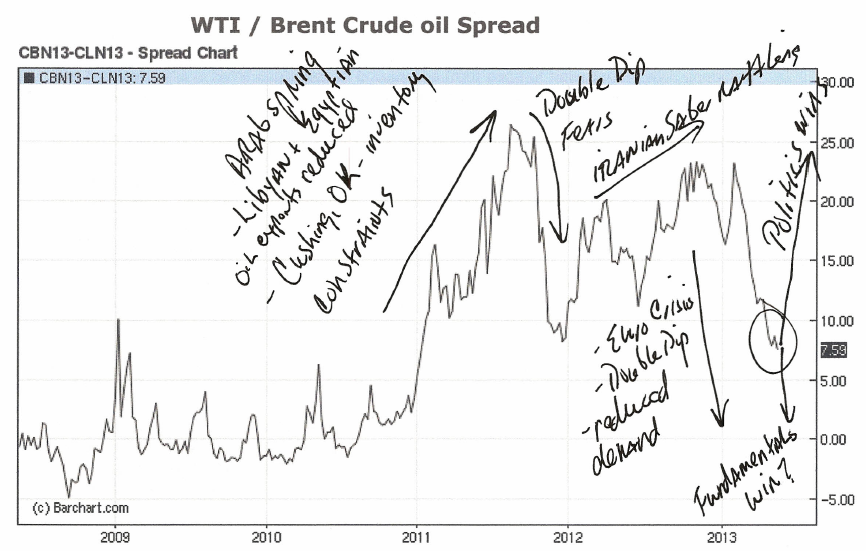

Brent/WTI Crude Oil Spread – Complacency or Just Fundamentals??

COMPLACENCY OR JUST FUNDAMENTALS??

- Greatest risk level since early 2011 to sudden spread widening due to real or perceived supply disruption/ headline risk.

- Supply/demand fundamentals continue to pressure the WTI/Brent spread lower towards the long term average of +/- $5.

- As North American production continues to increase and replace imported oil increasingly the WTI/Brent spread will reflect and be contained to Brent oil price swings.

- OPEC continues to reduce production, $90 per barrel price acceptable to OPEC and OPEC expects increase in demand from improving economies in the second half of the year. Continue reading

The Walls of the Fallen – OIF

On these walls are the names of the fallen soldiers of Operation Iraqi Freedom. The walls remain on what used to be FOB Warrior in Kirkuk, Iraq. Painted by their colleagues these walls would form a great foundation for a memorial in Washington, D.C. for all the fallen during this War on Terror. Remember them and all who have fallen or been wounded defending freedom and the United States this Memorial Day.

The Coming Civil War That Could Have Been Avoided

I wrote the following Op-Ed piece in the fall of 2011 while the US was negotiating with the Maliki Government of Iraq regarding the future status of any remaining US troops in Iraq after the previously agreed upon December 31, 2011 deadline for all troops to be out of Iraq. I reprint here because of the deteriorating situation in Iraq and the recent response by the Maliki government to a protest in Hawija in the Kirkuk Province. The response turned violent and 33 people were killed. Afterward the local tribal leaders’ comments were to the effect that peaceful demonstrations are over and it is time to pick up arms. That particular clash was Shia on Sunni. However, having taken place in Kirkuk is significant.

I lived in Kirkuk for three years as the senior economic development advisor with the Kirkuk Provincial Reconstruction Team (PRT) and to the Government of Iraq. Over the three year period my team and I engaged in over 600 missions outside the wire to meet with provincial political leaders, Baghdad ministerial leaders, the Governor, and local farmers and business leaders. In Iraq, PRTs were diplomatic outposts of the U.S. Embassy that partnered with Brigade Combat Teams, other U.S. Agency presence in Iraq, and the local provincial governments to foster political progress and build capacity critical for a stable and democratic Iraq. In the disputed province of Kirkuk we were welcomed and the local ethnic groups recognized the positive contributions and the stabilizing influence of the PRT and the U.S. Army.

EUROPE and the EURO at a Crossroads

The crisis in Europe and the Euro is not a surprise to students of economic history. Never in history has there been a sustainable single currency that crossed sovereign boarders. The Euro was intended as a big first step forward on the road to European economic and political union. The reality is that a unified currency cannot survive without political union. The vulnerability of the Euro as a single currency is the same as any fixed rate currency regime or a gold standard for that matter. If sovereign countries, as the term implies, have independent fiscal policies, labor policies, and overall economic policies then those more profligate countries will pressure a currency that they have no control over. This has happened throughout the monetary history. Indeed, it is why there are no fixed rate currencies regimes today, nor a gold standard. For all the insistence by gold bugs that a gold standard will prevent these sorts of crisis’s that occur from fiat money printing, it is precisely the pressures that printing money relieves that make fixed rate regimes unsustainable. Governments have an uncontrollable appetite for money and the theoretical discipline of fixed rate regimes is no match for politics.

That “great sucking sound…”

The White House insists that the vast majority of economists support the President’s economic policies. John Taylor, Economics professor at Stamford and former Undersecretary of Treasury for International Affairs doesn’t. His must see interview found can be found at WSJ.com. The comparison to the recovery out of the late 1970’s early 1980’s recession is dramatic. The longest period of economic expansion since World War II was initiated and fueled by economic policies exactly the opposite of President Obama’s. To get the economy out of a persistent stagflation, President Reagan reformed the tax code and reduced regulations while Federal Reserve Chairman Paul Volker tightened monetary policy to beat down historically high inflation. Today the economic recovery is constrained by stifling regulations and taxes increases while the Federal Reserve battles the restrictive fiscal policy with its only weapon loose monetary policy. Arguably the Fed’s policies are the only instrument, as imperfect as it is, that has kept the economy from returning to recession in face of a fiscal policy overwhelmed by the politics of class warfare and the insatiable needs of growing government. To borrow from candidate Ross Perot that “great sucking sound” isn’t coming from south of the border any more, it’s coming from Washington, D.C.

Harvard’s Stephen Walt waltzed past the facts in his “Top 10 Lessons of the Iraq War”

Harvard Professor Stephen M. Walt’s March 20, 2012 article in Foreign Policy Magazine reflects yet another example of the bash America liberal elite this time in a superficial attempt at describing the “Top 10 Lessons of the Iraq War,” without regard, of course, for the realities on the ground.. http://atfp.co/1TlspN4

It is far too early to declare whether the US won or lost in Iraq. Yet Harvard Professor Stephan Walt contends in his Lesson #1: The United States lost. It’s true after countless interviews and interrogations of high level Iraqi officials, including Saddam Hussein; there was no resurgence of a WMD program in Iraq. US intelligence agencies weren’t the only ones with “definitive” evidence of WMDs: Israelis, Italians, French, and British all purportedly had independent intelligence supporting a restart of a threatening WMD program in Iraq. Saddam Hussein proved quite effective in his efforts to mislead the West about his WMD intentions and capabilities.

Is Israel telegraphing to the world an imminent move against Iranian nuclear facilities? Oil traders think so!

The ratcheting up of rhetoric by Israeli officials focused on Iranian nuclear ambitions has culminated in recent weeks with an Israeli military official describing the threat to Israel as greater than the threat they faced during the run up to the Six day War, and the Aug 6 op-ed piece in the WSJ by Michael Oren, Israeli Ambassador to the US, stating that the window for effective action against Iran is narrowing quickly. The importance of Amb Oren’s comments is that an Israeli official is placing a time frame for Israeli/Western response.

The Heyday for Gold, Crude Oil, and US Treasuries is Over…..

The rallies in gold, crude oil, and US Treasury notes and bonds are done! These investments represent the greatest risks in the markets today. I’ll leave US Treasuries for a later post.

While both crude oil and gold prices are easily subject to headline risk with the saber rattling of Iran and threats of closing the straits of Hormuz, investors should be viewing additional gains as opportunities to get out fast and look to redeploy elsewhere.

Fed’s policy did not cause gold price rise.